‘Tis the season of festive dinners and gift-giving! Have you carefully thought of how you’re going to maximize your time, resources, and most importantly, budget?

During the Christmas season, we tend to be more lenient when it comes to spending and budgeting what with all the presents we want to give and parties we have to throw or attend. This year, Australians are estimated to spend more than $11 billion in gifts alone. If you’re not mindful enough, it’s easy to get carried away and rack up debt fast, so you’d do well if you create a budget plan for the holidays.

If you’re unsure as to how or where to start, below is a round-up of 12 budget planning tips for the holidays to help you have a merry celebration without breaking the bank.

- List down your holiday expenses.

- Set your budget limit.

- Track your spending.

- Always pay in cash.

- Shop early.

- Do your shopping online.

- Be in on bargains.

- Snag gift cards and coupons.

- Cut back on daily expenses.

- Sell personal items you don’t need.

- Gift baked goods or home-cooked recipes.

- Create DIY presents.

- List Down Your Holiday Expenses.

You can skip all the other budget planning tips in this blog except this one. It’s easy to overspend this holiday if you’re not careful and mindful of where you’re spending your money. Before you go on any Christmas shopping spree, make sure to have a list of all the items you need to buy or to do. Write it down on a piece of paper or as notes on your mobile phone for convenience.

- Set Your Budget Limit.

Your homework doesn’t end by listing down your holiday expenses. The next most critical tip to not overspend is to set your budget limit, and, of course, to stick to it. Make your holiday list more hardworking by writing down your working budget beside each item on your list. When you do this, better to put the prices a little higher than the average retail price in the market. This trick could save you a lot of trouble and pennies later.

If you’re a seasoned shopper, you shouldn’t have much trouble estimating the costs of the products or services you need. But if you’re not, make a quick consultation of the prices online. Be wiser by comparing prices from different retailers.

- Track Your Spending.

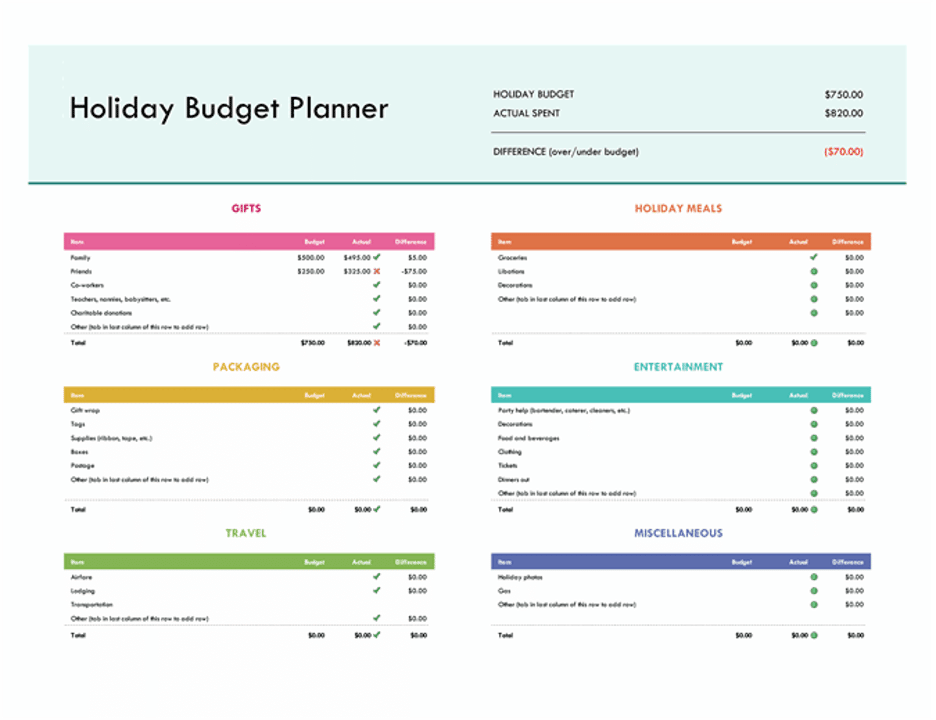

Image source: Templates.office.com

If you’re serious about your holiday budget planning, consider tracking your purchases the smart way. While it’s great to list down your expenses the traditional way using a pen and paper, it would be far easier and more convenient to leverage today’s tech apps.

You can use an Excel Sheet, which you can save on your laptop or phone. Download any of these printable holiday budget planner templates from Microsoft. Or why not go hassle-free? Simply download one of the best expense tracker apps for mobile and start tracking your expenses on the go!

- Always Pay in Cash.

While it’s convenient and, more often than not, tempting to purchase goods on credit, smart shoppers know it isn’t the best way to do shopping. You’re much more prone to lose track of your budget planning if you swipe credit cards here and there than when you use cash. This actually has a psychological explanation.

A study found that it’s mentally less painful for people to pay using a credit card over cash. When physically paying using their hard-earned cash, people tend to think twice before throwing items in their grocery basket. Shoppers are more likely to stick to their budget because they will try harder to stretch their money.

- Shop Early.

Avoid the sea of shoppers during the holidays by doing your shopping weeks or even months before the big event. While it’s true that retailers and brands tend to run special deals exclusively for the holidays, it’s likewise true that the prices of in-demand products tend to go

up during this season. If you want to spare yourself the trouble from crowded grocery aisles and long lines at the counter, do your shopping ahead of most people.

- Do Your Shopping Online.

The world of e-commerce is just wonderful, and shopping online has certainly increased in popularity due to the pandemic. It is advantageous, too, in so many ways: you have more options to choose from, it saves you time and energy from physically visiting stores, and brands offer generous deals and discounts.

- Be in on Bargains.

Another great tip to ensure you keep your budget planning in control is to shop wisely. Is there an upcoming sale in your local mall aside from the usual holiday and payday deals? Is your favorite brand having a special sale or anniversary sale? What about your local shops and thrift shops?

Before you splurge, make sure to do some money-saving research first. Score some discounts when you buy in bulk and use your membership cards to your advantage. Supermarkets and large retailers almost always run their biggest promo sales and discounts but be cautious of marketing ploys, as well.

- Snag Gift Cards and Coupons.

Image Source: USA Today

Are you a scrooge online? Now is the time to check if you have any existing or unclaimed gift cards or coupons, physical or electronic, from your favorite brands and stores. Grab these deals to reduce your expenses. A penny unspent is a penny saved!

Gift cards are nice presents as well. If you’re having a hard time picking a gift for someone whom you know is a little difficult to buy for, you can use gift cards as alternatives.

- Cut Back on Daily Expenses.

When you’re not expecting any other streams of income aside from your monthly paycheck, it will do you good to cut back on some of your daily expenses to add to your holiday budget.

Forgo your daily to-go coffee, dine out less often, or carpool a few days a week to save on gas expenses. All these little sacrifices will soon add up and help you reach your target budget. Who knows? If you stick to it long enough, you might even be able to develop a better budget-saving routine from this temporary setup.

- Sell Personal Items You Don’t Need.

Another practical scheme you can easily do before the holiday kicks in is to make some extra cash from selling personal items such as clothes, books, jewelery, gadgets, or furniture that you no longer need. If you have lots of unused items that are just left there collecting dust, now is the time to put them to better use.

- Gift Baked Goods or Homecooked Recipes.

Image source: Pexels

Have any heirloom recipes you’re proud of and people often compliment you about? That could be the perfect Christmas gift to your favorite neighbors or in-laws!

For your little nieces and nephews, why not whip up their favorite cookies and wrap them in nicely decorated boxes? Quickly go to Huffpost’s list of holiday cookies that make great gifts to have an idea.

If you’re confident in your cooking or baking skills, then give it a go. After all, gifts don’t always have to be extravagant. A recipe cooked with love sure wins many hearts!

- Create DIY Presents.

Image source: Pexels

Don’t limit your holiday presents to buying gifts from stores. It’s always an ingenious idea to give DIY gifts to people you’re closest to, from handicrafts, homemade candles, shelf displays, and ornaments. The list goes on. You can even take this opportunity to give a personal touch to your presents to make them extra memorable for the person.

Not too creative with your hands? All you need is a little bit of imagination and guidance, which you can plenty get online through YouTube tutorials. Check out this list of DIY gifts you can easily recreate at home.

Christmas need not be a total budget-buster. Customize your budget planning according to your needs and financial capacity. Remember, expensive isn’t always impressive, and being thoughtful is what always counts. With discipline and creativity, you can certainly cut back on your holiday expenses and save some for other purposes you might have in the future.