The debate on purchasing a house or unit as an investor is a contentious one. We sat down with Jarryd Gauci, Property Investment Consultant at Meridian Australia, to see which option is more suitable.

Which options provides the strongest returns?

For residential property investment, many investors simply are lost when deciding whether they should invest in a unit or a house. Investors are unsure about which option will provide them with the strongest return over the long term. Both dwelling types have had strong performance within the Australian markets in past growth cycles, however, there are several factors that hold significant influence over which is a more suitable option, all based on the market conditions of that period. The goal for any investment is to obtain the strongest return possible, so in this article, I delve into the pros and cons for both dwelling types.

House Pros.

- Floor space: Generally houses have a generous floor plan, attracting both tenants and future buyers, usually larger than the size of a unit. The increased space can increase the overall demand for the property.

- Price premium for land: Having additional land value can assist with the overall capital growth of the property. Land can appreciate if there is a limited supply, and as the population increases, the demand for land can also increase. In any market, investors should conduct careful research into the suburb to determine if there is a limited supply of property being offered to buyers.

- Flexibility: There is no owners’ corporation or strata laws when you invest in a house. There may also be the opportunity to add value to the property with future renovations or additional landscaping.

House Cons.

- Ongoing maintenance: With more floor space and additional land comes additional ongoing maintenance of the property compared to a unit. Potential maintenance and upkeep of the property needs to be factored into the projected cash flow of the property.

- Higher costs: The landlord insurance and council rates you pay for a house are generally higher than for unit owners. Sometimes landlord insurance can actually exceed what you would pay in strata for a unit.

Unit Pros.

- Affordability: Generally, units have a cheaper entry point compared to houses, so investors are able to secure their next investment property sooner rather than later. Additionally, the median unit price is significantly less than the median house price for all capital cities in Australia.

- Less maintenance: The maintenance and care of a unit building and surroundings is the responsibility of the body corporate, instead of with a house where all maintenance and care is your responsibility.

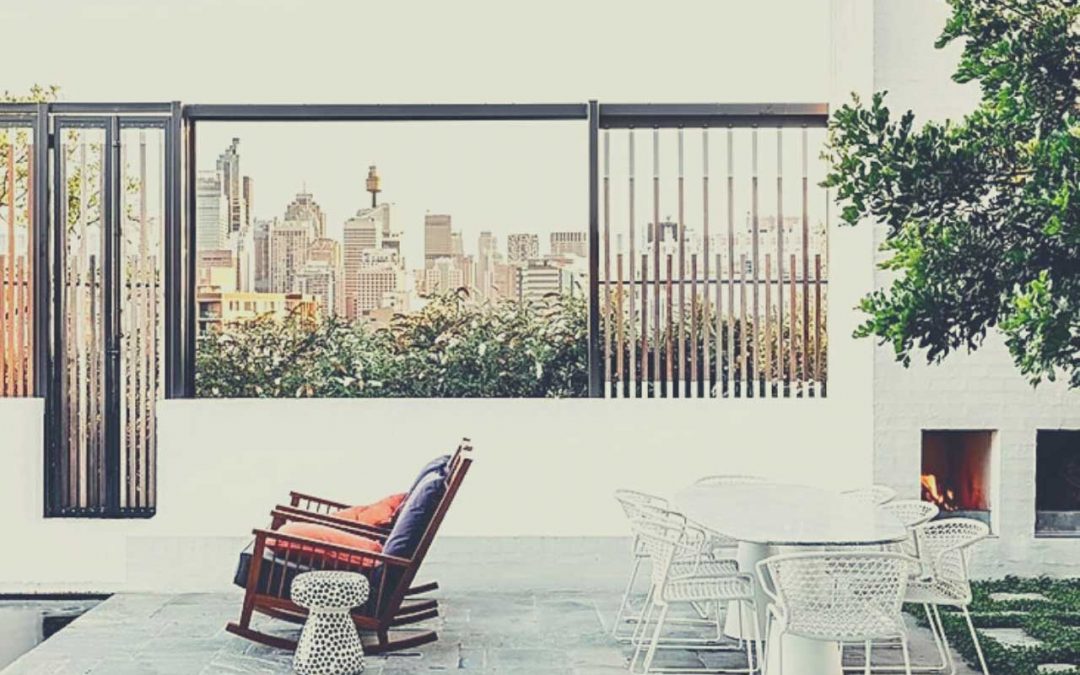

- Location: Many units are built near city centres, allowing for closer proximity to transport, schools, restaurants and employment nodes. This makes the property not only attractive to tenants, but also to future buyers. Being close to a thriving CBD will assist with potential demand for the market and the property.

Unit Cons.

- Strata/Owners’ corporation by-laws: This means, unit owners must abide by the rules imposed by the owners’ corporation, including factors such as not hanging washing over the balcony or not having pets in the property. If you want your unit to be pet friendly to attract more potential tenants and future buyers, you may need to seek approval prior to engaging in this activity.

- Fees: You will also need to pay a fee to the owners’ corporation to cover shared maintenance costs. Remember to take this into consideration when conducting a cash flow and considering the overall costs.

- Less space: Units don’t usually offer as much living and outdoor space as houses. Even though this can be positive for some buyers and tenants, it may also deter others.

Summary

Now that you’re familiar with some of the pros and cons, consider the purpose behind your investment and your overall long term strategy. Cash flow and capital growth prospects are both very important and should be considered whether investing in a house or a unit. Always conduct your own research and due diligence when reviewing a property for potential investment and make sure you understand what the market is demanding, whether that is a unit or a house.

Jarryd Gauci – Property Investment Consultant

Phone: 02 9939 3249

Email: jarryd@meridianaustralia.com.au

Facebook: https://bit.ly/Meridian-Australia-Facebook

Instagram: https://bit.ly/Meridian-Australia-Instagram

LinkedIn: https://bit.ly/Meridian-Australia-Linkedin

If you would like to get further insights into determining which strategy is the most suitable for you, reach out to the talented team at Property Investment Consultancy Meridian Australia here.

*Disclaimer: When considering purchasing property, it is always prudent to seek the advice of an appropriately qualified professional to determine which strategy is most appropriate for your individual circumstance.459